SAP InterCompany Integration 2.0 – Part II

If you are part of a growing organization, that controls more than one legal business entity, and you seem to face the challenge of how to share data and perform intercompany transactions between partner companies, this blog post might help you.

Make sure you read Part I about SAP InterCompany Integration Solution.

SAP InterCompany 2.0 – Part II

There are several topics where SAP InterCompany Integration Solution for SAP Business One has several advantages. In the following sections, you can read more details and find some examples.

InterCompany Reporting

When you use Group Reporting, your business benefits are:

- You can consolidate, coordinate, and view activities across all business units running SAP Business One without manual reconciliation

- You are able to manage multiple subsidiaries, business units and legal entities

- You experience a reduced cycle time required to collate, consolidate and report financial data

- You have access to an easy and intuitive management of cross-subsidiary financial information

- You enable controlling for accurate analysis, as reports use real-time information

Operational visibility and risk management are key considerations for any business with multiple operational units. The reporting in InterCompany integration solution for SAP Business One allows user to view the realtime information, enabling accurate analysis of the financial data from one or all branch companies. The user can export the interCompany report to Microsoft excel, copy/paste to Microsoft word or print as a PDF document.

InterCompany solution provides standard reports in the system and also allows user to create additional reports using query wizard in SAP Business One. Examples:

- Branch Inventory in Warehouse Report

The application gives detailed visibility of inventory status of items across the organization. The application lists current inventory of all items in each subsidiary, including foreign subsidiaries – providing in-stock, committed, ordered, and available quantities - Branch Sales Analysis Report

Consolidated sales for each operating entity can be viewed in a single report, to know how products are selling across various regions. - Branch Balances Report

The report provides an organization wide single view of all payables and receivables from trade between the business units and subsidiaries - Consolidated Balances by Business Partner

This report displays the real-time consolidated account balances of the global business partners across branch companies - Unposted InterCompany Transactions Report

The report lists all incoming interCompany documents that are not yet accepted and posted by the receiving subsidiary - Multilevel Financial Consolidation Reporting

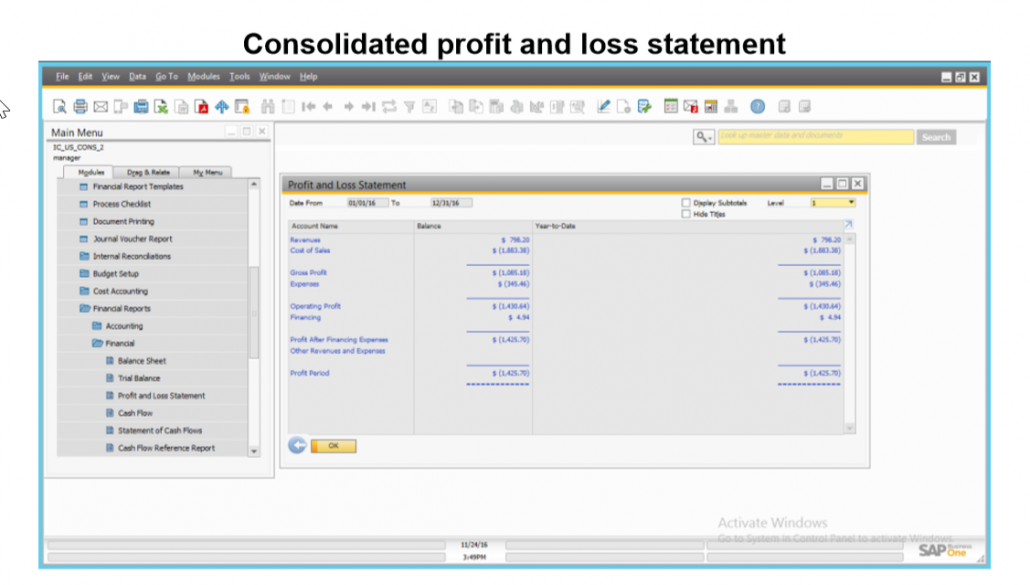

- Consolidated trial balance

- Consolidated profit and loss statement

- Consolidated balance sheet

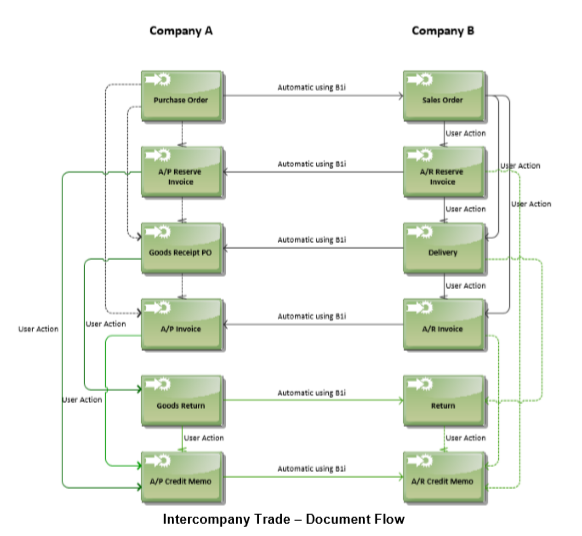

InterCompany Trade and Documents Exchange

The management of InterCompany transactions for multiple companies by automatically replicating corresponding transactions between the company databases leads you to the following business benefits:

- You experience increased productivity by reducing workload

- You profit from a significant reduction in errors

- You have an overall increase in operational efficiency

- You eliminate redundant data entries

- You gain from improved data quality

The ability to automatically create a related (reciprocal) transaction in the other application eliminates manual data entry, improves employee productivity, and reduces the potential for errors from rekeying data. Example: OEC New York and OEC Texas are 2 companies that perform interCompany trading. Creating a purchase order in company OEC-NY triggers the automatic creation of a sales order in OEC Texas.

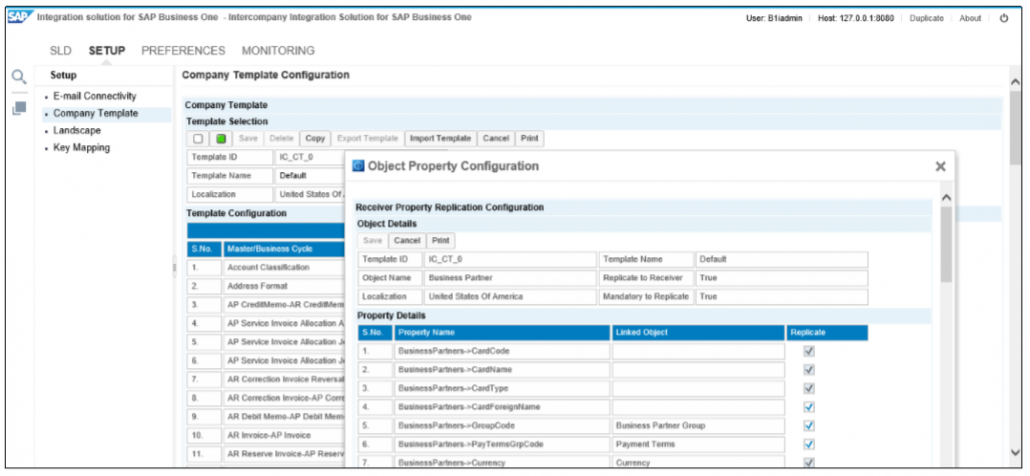

Master Data Replication

InterCompany solution ensures the same master data across all companies, so you can experience the following business benefits:

- You improve quality and accuracy of data

- You increase productivity by reduction in workload

- You gain an overall increase in organizational efficiencies

- You minimize errors in master data entry across the organization

Master data such as item masters and business partner master data should be in sync across all organizations, so that the same data is used across the companies. This establishes a common language among business entities for interCompany transactions. It also provides a common frame of reference for analyzing the performance of a business unit, interpreting reports from two different subsidiaries, and gaining a consolidated view such as aggregate spend or inventory holdings across all operations.Having common master data eliminates the manual effort associated with aggregating data across your organizations. InterCompany integration solution ensures that the master data being used across the companies is consistent.

Example: With the Company Template configuration, user can specify the master that needs to be sent from one company to the others. For each master, user can also specify the field list to be replicated between the SAP Business One Companies:

Consulting Support is recommendable

This entire topic is quite complex, especially because the differences can be found deep in detail. Our experience shows that a requirement workshop is mandatory to gain an holistic view of your entire business transactions with your collaborating business units. Our experience also shows that when setting up the InterCompany solution, all legal entities need to be involved in the discussion.

Feel free to drop us a line to get more into detail.